8 Best Solana Staking Pools + How to Choose [2025]

![8 Best Solana Staking Pools + How to Choose [2025]](/v3/img/containers/blog_main/blockchain.jpg/0ee7c10cd1b2699b0fec51a87d63af75/blockchain.jpg?id=1739046670)

#8 Best Solana Staking Pools + How to Choose [2025]

As the Solana ecosystem continues to expand, with over 400 billion transactions processed as of 2025, staking SOL remains one of the best ways to earn rewards on the platform. This guide presents a curated list of the best Solana staking pools and how to evaluate factors like annual percentage yield (APY), fees, security, and validator reliability.

#What is Solana staking?

Solana staking is the process of locking up Solana’s native cryptocurrency, SOL, to support the blockchain’s Proof of Stake (PoS) consensus mechanism. By staking SOL, participants help secure the network, validate transactions, and maintain its decentralized structure while earning rewards.

Solana staking works in three main steps:

- Delegation to validators: Users delegate their SOL tokens to validator nodes, which validate transactions and produce new blocks. Validators with more delegated tokens are more likely selected to validate transactions.

- Proof of Stake (PoS) and Proof of History (PoH): Solana combines PoS with Proof of History, a cryptographic technique that ensures efficient and scalable transaction processing.

- Epochs: Staking and unstaking take effect at the boundaries of epochs. An epoch is a defined period in which certain network activities, including staking and unstaking, occur. It lasts 2-4 days, after which rewards are distributed.

#What are Solana staking pools?

Solana staking pools are collective arrangements where multiple participants combine their SOL tokens to increase their staking power. Here are the key features and benefits of staking pools:

-

Resource Pooling: By pooling resources, participants can meet the minimum staking requirements for validators that might be too high for individual holders.

-

Shared Rewards: Rewards earned from staking are distributed among all pool participants based on their contribution.

-

Lower Entry Barrier: Staking pools allow smaller holders to participate in staking without needing a large amount of SOL.

-

Passive Management: Pool operators handle the technical aspects of running the validator node, making it easier for participants who may lack technical expertise.

-

Decentralization: Some pools distribute stakes across multiple validators, helping to maintain network decentralization.

Staking pools are an attractive option for users looking for a simple way to earn staking rewards while contributing to the Solana network's security.

Get customizable and secure blockchain servers, designed for intensive Web3 workloads. Enjoy minimal downtime, crypto-friendly payments, and free 24/7 expert support.

#How to stake Solana?

There are various options for staking Solana (SOL), including native staking (directly delegating your SOL tokens to a Solana validator), liquid staking (staking assets while maintaining liquidity), staking pools (combining resources for shared rewards, our guide’s focus), or running your own Solana node (for those with technical expertise). Users can also utilize centralized exchanges or on-chain platforms for convenience.

In native Solana staking, if you’re a participant on the Solana blockchain, here are the steps on how to stake Solana:

- Choose a Solana-compatible platform or wallet such as Phantom or Atomic Wallet;

- Select a validator based on performance metrics like uptime and commission fees;

- Delegate your preferred amount of SOL (minimum 0.01 SOL);

- Wait for staking to activate after an epoch boundary;

- Monitor rewards, which are automatically added to your staked balance after each unstaking period.

#8 Best Solana Staking Pools in 2025

Several Solana stake pools have emerged as top picks among institutional and retail investors. While your choice depends on personal goals, we analyzed different platforms' APY, fees, and security and selected the best Solana staking pools for 2025.

Solana staking pools provide a convenient method that doesn’t require extensive technical expertise or significant initial capital.

#1. Marinade Finance

Marinade Finance is a leading staking platform on the Solana blockchain, offering native and liquid staking options. Users receive mSOL tokens, which can be used in DeFi for additional yield. The platform eliminates smart contract risks and optimizes validator selection automatically. Its instant unstaking feature allows users to unstake SOL immediately with variable fees.

APY: For native SOL staking, Marinade Finance offers over 10% APY, and around 11.8% APY for liquid staking.

Fees: The platform offers 6% of staking rewards for liquid staking and variable fees for instant unstaking.

Pros

- Offers high native staking rewards

- Liquid staking provides flexibility with mSOL tokens usable in DeFi

- Instant unstaking ensures liquidity access at any time

- Transparent validator monitoring and scoring system

Cons

- Liquid staking may impose smart contract risk

- Limited wallet integration for Marinade Native. Must use the dApp directly

Best for: Marinade Finance is best for users seeking high APY, institutional investors prioritizing security, and users requiring flexibility through liquid staking tokens like mSOL.

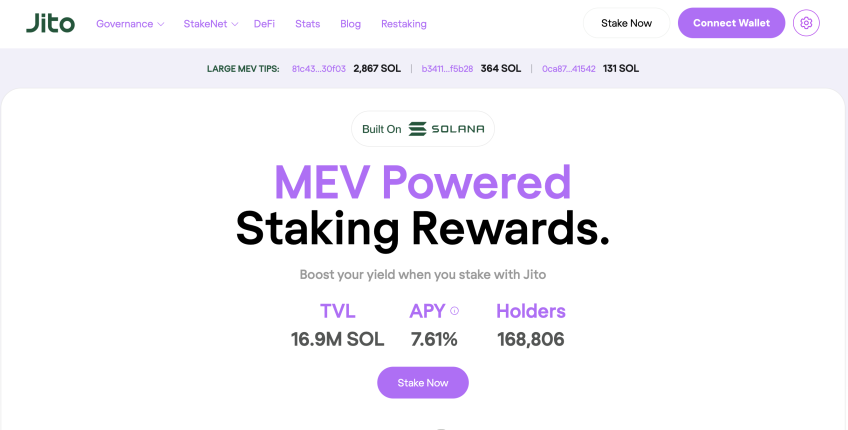

#2. Jito Network

Jito Network specializes in liquid staking, offering JitoSOL tokens that accumulate traditional staking rewards and Maximum Extractable Value (MEV) rewards. Its key features include DeFi integration through JitoSOL tokens, which can be used in lending and farming protocols for additional yield. Jito uses fair distribution technology that minimizes negative effects tied to MEV extraction while maximizing profits.

APY: The instantaneous annualized APY is around 7.46%, which includes traditional staking rewards and MEV rewards, making the pool competitive in the Solana ecosystem.

Fees: Transaction fees apply when converting staked SOL to JitoSOL tokens.

Pros

- MEV rewards provide an edge over traditional staking platforms

- Liquid staking ensures liquidity with JitoSOL tokens usable in DeFi

- Transparent governance through tokenholder votes on platform improvements

- Advanced technology enhances validator performance and reduces network congestion

Cons

- Lack of clarity on the exact APY compared to competitors like Marinade Finance

- Limited focus on native staking options, which might discourage users seeking higher fixed yields

Best for: Jito Network is most suitable for users interested in maximizing yield through MEV rewards and leveraging liquid staking for DeFi integrations.

#3. JPool

JPool is a versatile staking platform on the Solana blockchain, offering liquid staking and direct staking options. Users receive JSOL tokens, which can be used in DeFi while earning staking rewards. JPool platform allows users to manually select validators for customized strategies and incorporates MEV optimization for increased rewards. It’s also a gamified ecosystem with features like JPoints and games, which enhance user engagement.

APY

Liquid staking can go up to 15% APY, high-yield native staking can go up to 10% APY with MEV optimization.

Fees

JPool has a transparent fee structure, with low fees for staking and variable fees for unstaking depending on the method used.

Pros

- High APY potential with MEV optimization

- Flexible options for liquid and direct staking

- Gamified features like JPoints add user engagement incentives

- Developer-friendly integration for DeFi applications using JSOL tokens

Cons

- Slightly complex interface for beginners due to multiple staking options

- MEV optimization may not appeal to risk-averse users

Best for: JPool is best for users looking for high APY, flexibility in staking strategies, and DeFi integrations.

#4. Socean

Socean is a decentralized staking pool on Solana, emphasizing algorithmic delegation and liquid staking with scnSOL tokens. It supports liquid staking with scnSOL tokens, which can be used across DeFi protocols while earning rewards. Besides, Socean uses algorithmic validator selection to ensure optimal performance and network decentralization.

APY: The APY on Socean is approximately 7-8%, depending on validator performance.

Fees: Fees are minimal, with instant unstaking incurring a small fee or slippage. Delayed unstaking is free but takes 2-3 days.

Pros

- scnSOL provides liquidity and DeFi compatibility while earning rewards

- Transparent, algorithmic-driven validator selection enhances network health

- Decentralized governance empowers users in decision-making processes

- Non-custodial platform ensures user control over assets

Cons

- Socean has lower APY compared to competitors like JPool or BlazeStake

- Instant unstaking involves fees or slippage, which may discourage some users

Best for: Socean is best for DeFi enthusiasts looking for liquidity and decentralized governance in their staking solutions.

#5. BlazeStake

BlazeStake focuses on decentralization and ecosystem growth through its stake pool protocol. It offers bSOL tokens as liquid staking assets, which increase in value as rewards accrue and can be used in DeFi applications. With the validator decentralization strategy, BlazeStake spreads stake across over 200 validators to enhance network security and decentralization.

APY: BlazeStake offers competitive APY that compounds through bSOL appreciation relative to SOL.

Fees: Higher fees for instant unstaking, delayed unstaking has lower fees or none at all

Pros

- Strong focus on decentralization with the largest validator set among Solana pools

- bSOL tokens provide liquidity and can be used in DeFi while earning rewards

- Uses Solana Labs’ audited smart contracts for enhanced security

Cons

- Instant unstaking incurs higher fees compared to other platforms like Socean

- Airdrop benefits may not appeal to users uninterested in ecosystem tokens

Best for: BlazeStake is best for users prioritizing network decentralization, ecosystem contributions, and long-term value through bSOL tokens.

Check how the blockchain IaaS platform Zeeve leveraged Cherry Servers' secure dedicated bare metal servers to streamline their operations.

#6. StaFi Protocol

StaFi Protocol specializes in liquid staking, allowing users to stake assets and receive rTokens representing their staked value. The rTokens can be traded or used in DeFi applications while continuing to earn staking rewards. The platform embraces on-chain governance for voting on proposals and smart contract insurance to protect against bugs or hacks. StaFi Protocol is built on Cosmos-SDK for interoperability with other blockchains.

APY: StaFi currently offers approximately 22.46% reward rate for staking FIS tokens. Notably, these figures fluctuate and can change.

Fees: Fees depend on the provider used for staking

Pros

- High APY compared to other platforms

- Liquid staking enables trading and DeFi usage of staked assets

- Governance participation via FIS tokens

- Smart contract insurance adds security

Cons

- Limited adoption compared to mainstream platforms like Binance or Coinbase

- Complexity in understanding rToken mechanics for new users

Best for: StaFi Protocol is best for DeFi enthusiasts and advanced users seeking high APY and liquidity in their staked assets.

#7. Binance

Binance offers liquid staking for Solana via BNSOL tokens, which represent staked SOL while maintaining liquidity for DeFi applications. Binance maintains high throughput and low transaction costs due to Solana’s architecture and distributes rewards automatically after every epoch.

APY: Not explicitly stated but varies depending on validator performance and poor activity.

Fees: Service fees range from 25% to 35%, deducted from the rewards earned.

Pros

- Liquid staking via BNSOL allows flexibility in asset usage

- Secure storage with cold wallets ensures the safety of funds

- Low transaction costs enhance the profitability of staking activities

- Automatic reward distribution simplifies the process

Cons

- High service fees reduce overall earnings

- Processing time for staking requests can take up to three business days

Best for: Binance is ideal for users seeking secure, liquid staking options with access to DeFi applications.

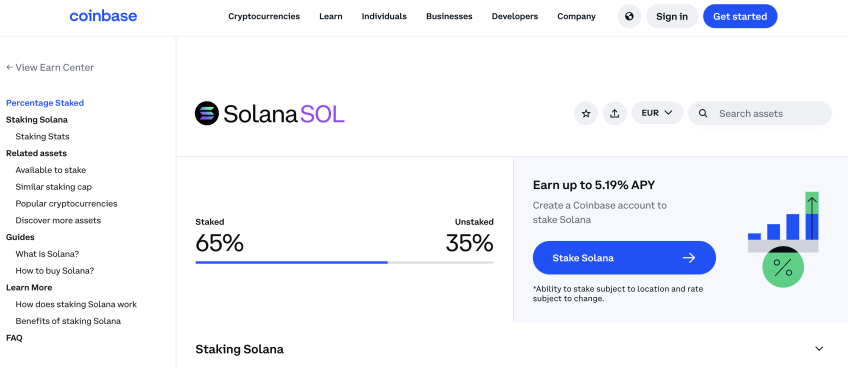

#8. Coinbase

Coinbase provides a straightforward staking solution for Solana with competitive reward rates and user-friendly features like easy enrollment and centralized asset management.

APY: According to the official website, the current reward rate for Solana staking is 5.59%.

Fees: Details about fees are not explicitly provided but are likely included in the platform's reward rate adjustments.

Pros

- Simple and intuitive platform suitable for beginners

- Reliable security measures to mitigate risks during staking

- Easy opt-out options provide flexibility in managing staked assets

- Accessible with as little as $1, making it beginner-friendly

Cons

- Lower APY compared to StaFi and Binance platforms

- A centralized nature may not appeal to users preferring decentralized solutions

Best for: Coinbase is most suitable for beginner investors looking for a simple, secure way to stake Solana.

#How to choose the best Solana staking Pool?

Choosing the best Solana staking pool requires a balanced approach that considers several factors, so you not only maximize your rewards but also support a healthy, decentralized network. Here’s a structured guideline to help you decide on the best Solana staking pool for you:

#Step 1: Evaluate validator performance

Reliable validator performance is critical because even brief downtime can reduce your overall yield.

- Uptime and reliability: Look for validators with near-100% uptime and a proven track record in processing transactions efficiently. Consistent performance minimizes missed rewards and penalties.

- Voting and block production: Check how often a validator participates in consensus and produces blocks. Tools like Solana Explorer or StakeView.app can provide these metrics.

#Step 2: Consider the commission fees

Comparing commission rates helps you understand the trade-off between maximizing yield and ensuring validator stability.

- Fee structure: Validators charge a commission on the rewards they earn. Lower fees mean higher net rewards for you, but if it’s too low, it might signal a new or less established operator.

- Sustainability: Ensure that the commission rate is balanced with the validator’s operational quality. A very low fee isn’t always a good sign if it compromises long-term reliability.

#Step 3: Assess decentralization and stake distribution

Diversifying your stake among several well-performing validators can mitigate risk and support a healthier network ecosystem.

- Network health: Choose tools that help prevent over-concentration. When you delegate too much SOL to a single validator, it can harm network decentralization and even cause systemic risks.

- Validator size: Sometimes, smaller or mid-sized validators with strong technical setups and community engagement can offer competitive rewards while contributing to decentralization.

#Step 4: Check reputation and transparency

A strong reputation and transparency in operations are key indicators of a trustworthy staking pool.

- Community feedback: Look for validators with active communication channels, including Discord, Telegram, or Reddit, and transparent operations.

- Track record: Long-standing validators or staking pools that are endorsed by trusted platforms (like Solana Beach or Solana Compass) can offer additional insurance.

#Step 5: Consider additional features and flexibility

Extra features can enhance your overall yield and offer more control over your assets.

- Liquid staking options: Some pools offer liquid staking, allowing you to earn rewards while retaining liquidity.

- Minimum requirements and lockups: Check if there are minimum staking amounts or any lock-up periods that might affect your flexibility.

#In Conclusion

Choosing the right Solana staking pool is about finding the perfect balance between performance, fees, and network health. The 8 best Solana staking pools highlighted here not only offer competitive rewards but also demonstrate a commitment to decentralization and transparency.

Whether you prefer liquid staking for added flexibility or traditional delegation for simplicity, remember to do your research, monitor validator performance, and diversify your stake to mitigate risk.

Cherry Servers offers high-performance dedicated servers for your Solana projects. Our secure Solana servers offer excellent cost vs performance optimization, speed, and reliability, ensuring your Solana validator nodes run smoothly and efficiently.

Dedicated Servers Optimized for Solana

Deploy your nodes on dedicated hardware designed to meet Solana validator requirements.